As Global Demand for AI Grows, Nvidia Finds Itself Navigating Politics, Trade Wars, and Technological Rivalries

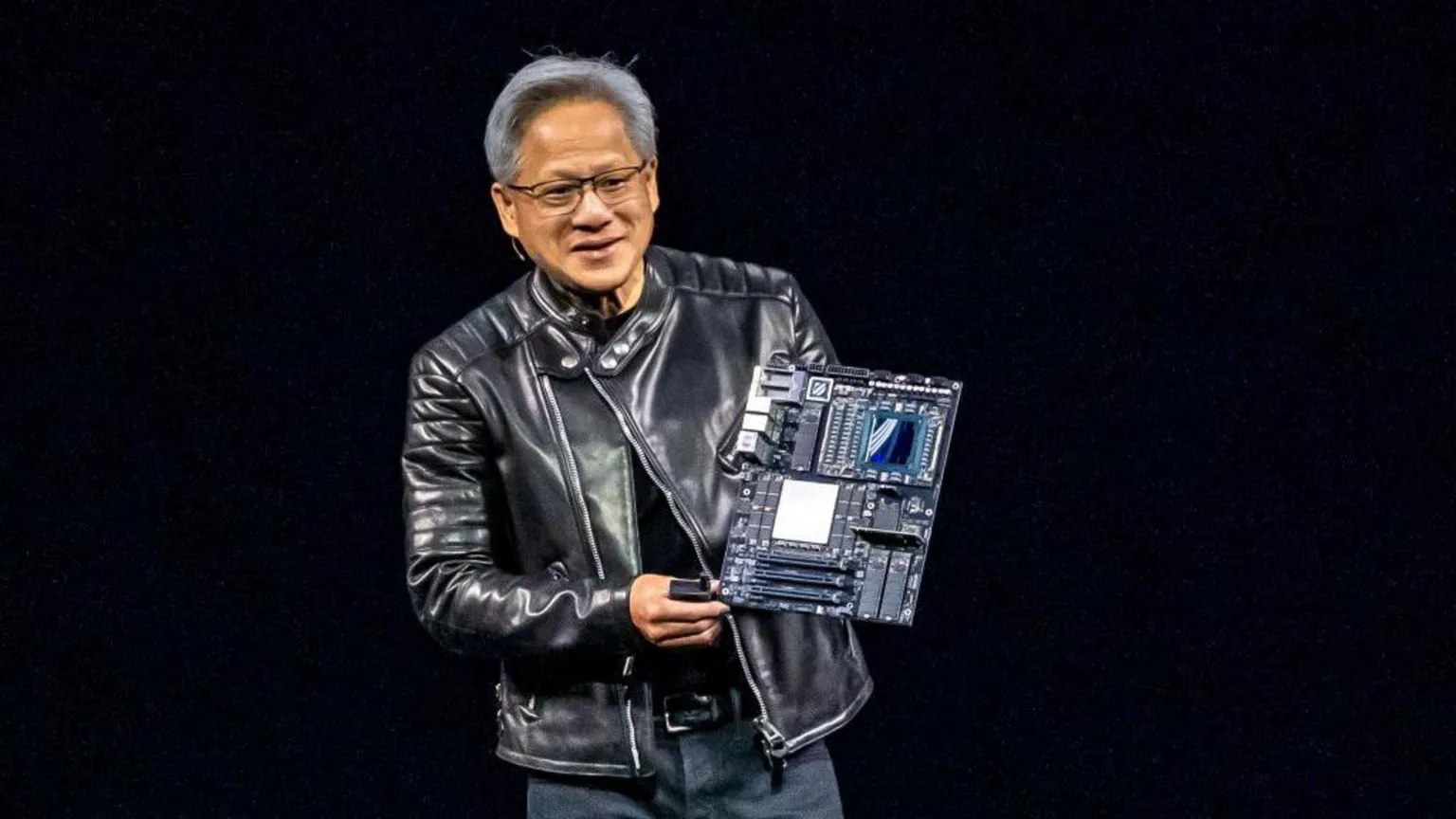

Nvidia, once known primarily for its graphics cards powering video games, is now arguably the most powerful player in the global AI race. Under the leadership of its charismatic CEO Jensen Huang—dubbed the “Taylor Swift of tech”—Nvidia has become not only a market leader in AI chip design but also a central figure in the ever-growing tensions between the United States and China.

The Heart of the AI Revolution

Nvidia’s advanced chips are the backbone of generative AI systems like ChatGPT, enabling machines to create human-like text, images, and even code. The company’s dominance in this space has propelled it to staggering heights, even briefly overtaking Apple in 2024 to become the world’s most valuable company by market capitalization.

But with great power comes intense scrutiny.

A Battle Over Technology and Power

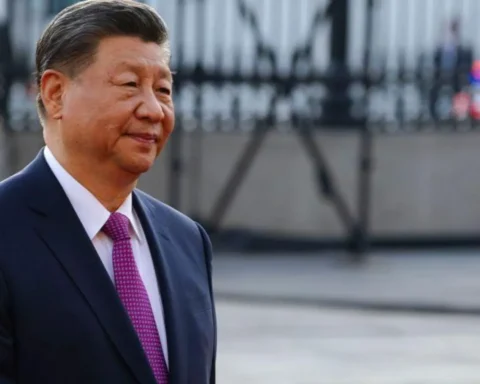

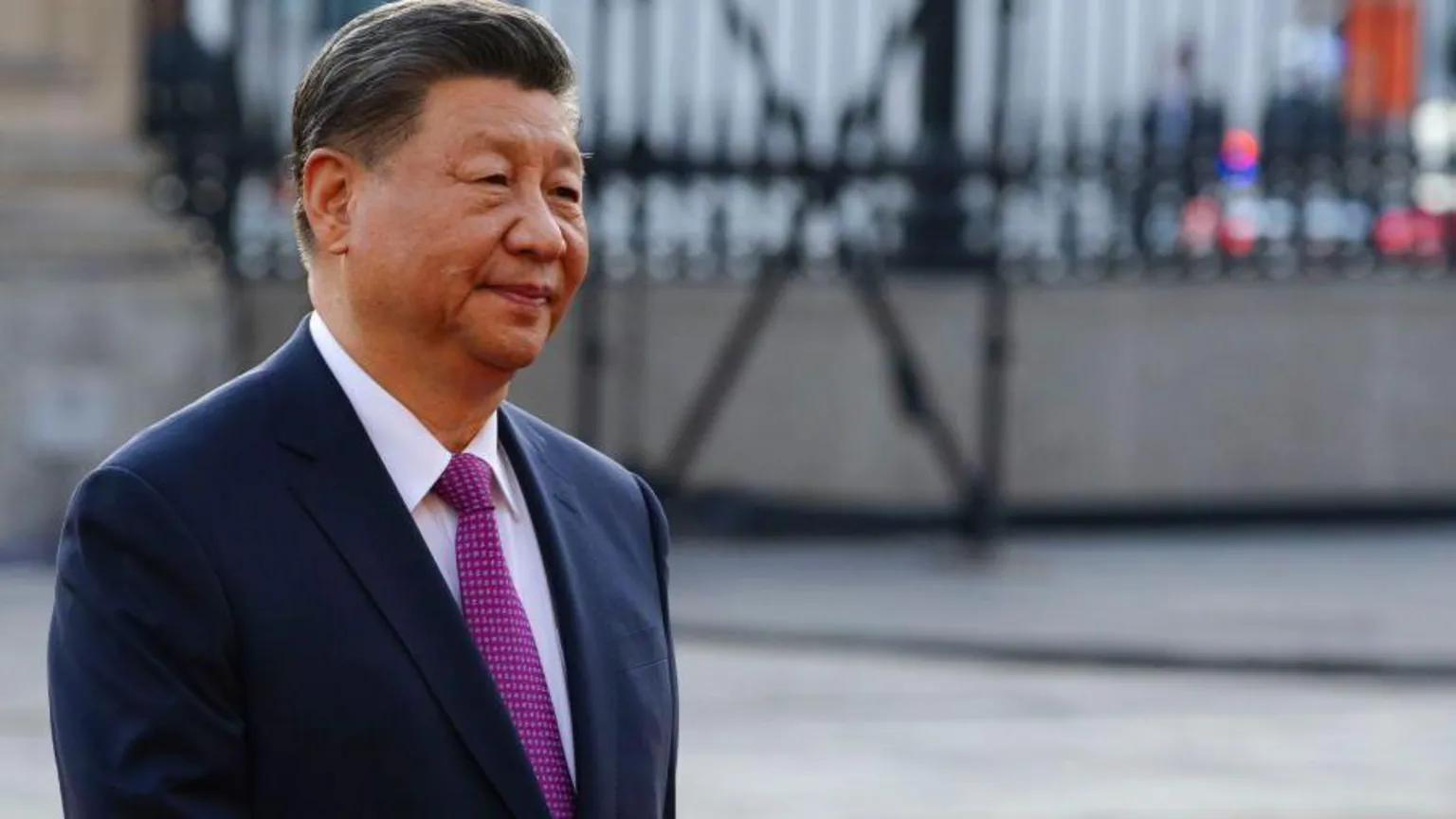

On Thursday, Nvidia’s CEO Jensen Huang landed in Beijing to meet with senior Chinese officials—just days after the U.S. introduced strict new export controls on Nvidia’s H20 chip, designed specifically for the Chinese market. The chip, a more limited version of Nvidia’s powerful H100 (already banned from export), was created to comply with previous restrictions. But now, even the H20 will require special licenses for export.

The U.S. Commerce Department justified the move as a measure to protect national security, fearing that even less powerful AI chips could accelerate China’s military AI capabilities or help companies like DeepSeek—the Chinese answer to ChatGPT—make leaps in generative AI.

The Financial Fallout

The timing couldn’t be worse for Nvidia. With billions of dollars in outstanding orders from Chinese tech giants like Alibaba, Tencent, and ByteDance (TikTok’s parent company), Nvidia stands to lose an estimated $5.5 billion from unfulfilled shipments.

These losses, paired with increased scrutiny and a tightening grip from U.S. regulators, have led to a sharp decline in Nvidia’s shares—signaling how political decisions are increasingly reshaping the future of tech innovation.

Why China Still Matters to Nvidia

Despite tensions, China remains a crucial market. It accounted for 13% of Nvidia’s global sales last year. Huang’s visit to Beijing, including a high-profile meeting with DeepSeek’s founder and top government officials, signals Nvidia’s intent to maintain strong ties in China, even as U.S. policies create barriers.

In meetings with trade leaders and the mayor of Shanghai, Huang expressed optimism and commitment to continued collaboration. According to Chinese state media, Huang emphasized China’s enormous potential for AI investment and innovation.

The Bigger Picture: A Divided Tech World

The Nvidia case is more than just one company’s challenge—it’s symbolic of a broader shift. The world’s technology infrastructure is now being split into two spheres of influence: one led by the U.S., and another by China.

Efforts to “de-risk” the global supply chain have prompted massive investments back home. Nvidia has pledged to build up to $500 billion worth of AI servers in the U.S. Meanwhile, TSMC, Nvidia’s chip manufacturer, announced a $100 billion expansion of advanced fabrication facilities in Arizona.

Economists and analysts warn this fragmentation will make technology less global, more restricted, and potentially more expensive. Yet, this may also fuel parallel innovations in both regions—each trying to outpace the other.

As the AI boom continues, Nvidia remains at the very heart of a global battle not just for market share, but for technological supremacy and geopolitical control. What happens next will shape the future of artificial intelligence—and possibly the balance of power—for years to come.

Post Views: 1